The Growth Engine

for Parent & Teen

Account Openings.

Dream helps credit unions engage local families and grow new memberships through co-branded graphic books that teach teens entrepreneurship and finance.

Educate teens

Increase engagement

Drive youth membership

Boost financial literacy

Inspire entrepreneurship

Strengthen brand loyalty

Empower young members

Develop lifelong skills

Enhance community impact

Future-proof your CU

Grow parent & teen memberships

Build CU awareness

Educate teens

Increase engagement

Drive youth membership

Boost financial literacy

Inspire entrepreneurship

Strengthen brand loyalty

Empower young members

Develop lifelong skills

Enhance community impact

Future-proof your CU

Grow parent & teen memberships

Build CU awareness

Educate teens

Increase engagement

Drive youth membership

Boost financial literacy

Inspire entrepreneurship

Strengthen brand loyalty

Empower young members

Develop lifelong skills

Enhance community impact

Future-proof your CU

Grow parent & teen memberships

Build CU awareness

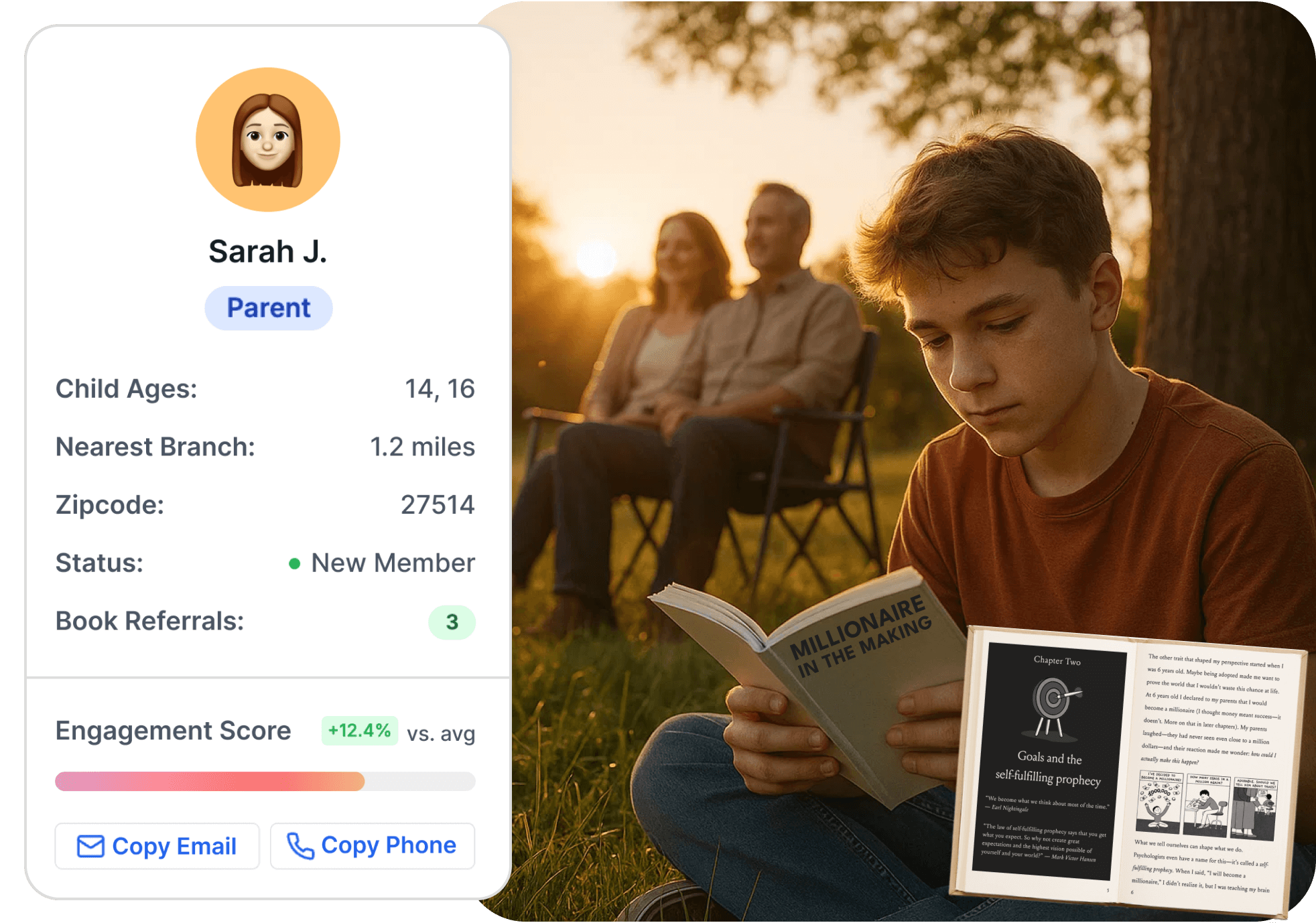

Accelerate new member growth through families.

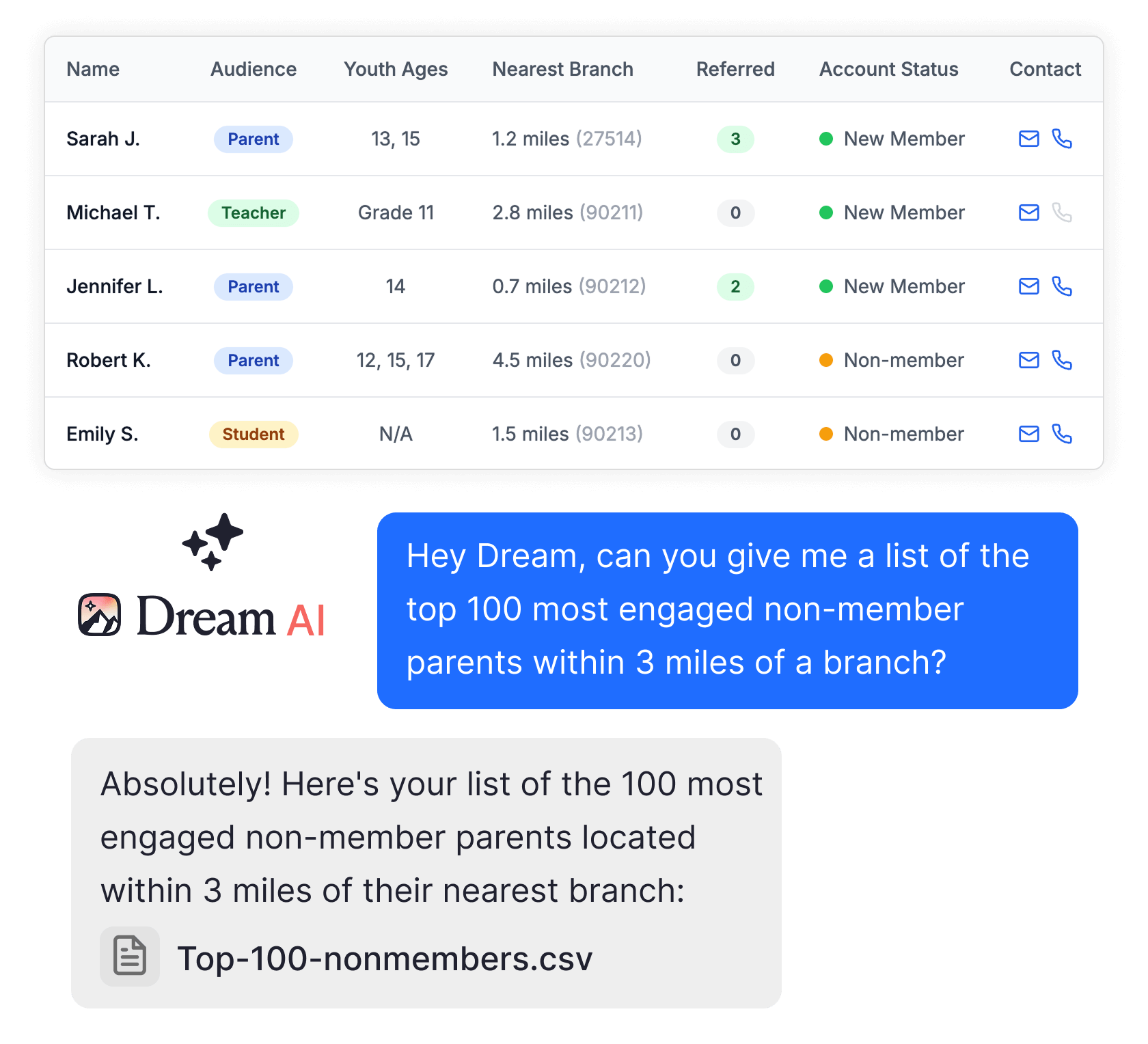

Most new accounts are opened within 3 miles of a branch—Dream offers a turnkey solution to reach the right families.

- Drives parent & teen signups

- Introduces families new to your CU

Deliver real-world education teens want & need.

Dream uses storytelling and hands-on challenges to make skills click.

- Co-branded, Jump$tart Standards-aligned

- Works in schools, branches, or at home

- Built for the attention spans of teens

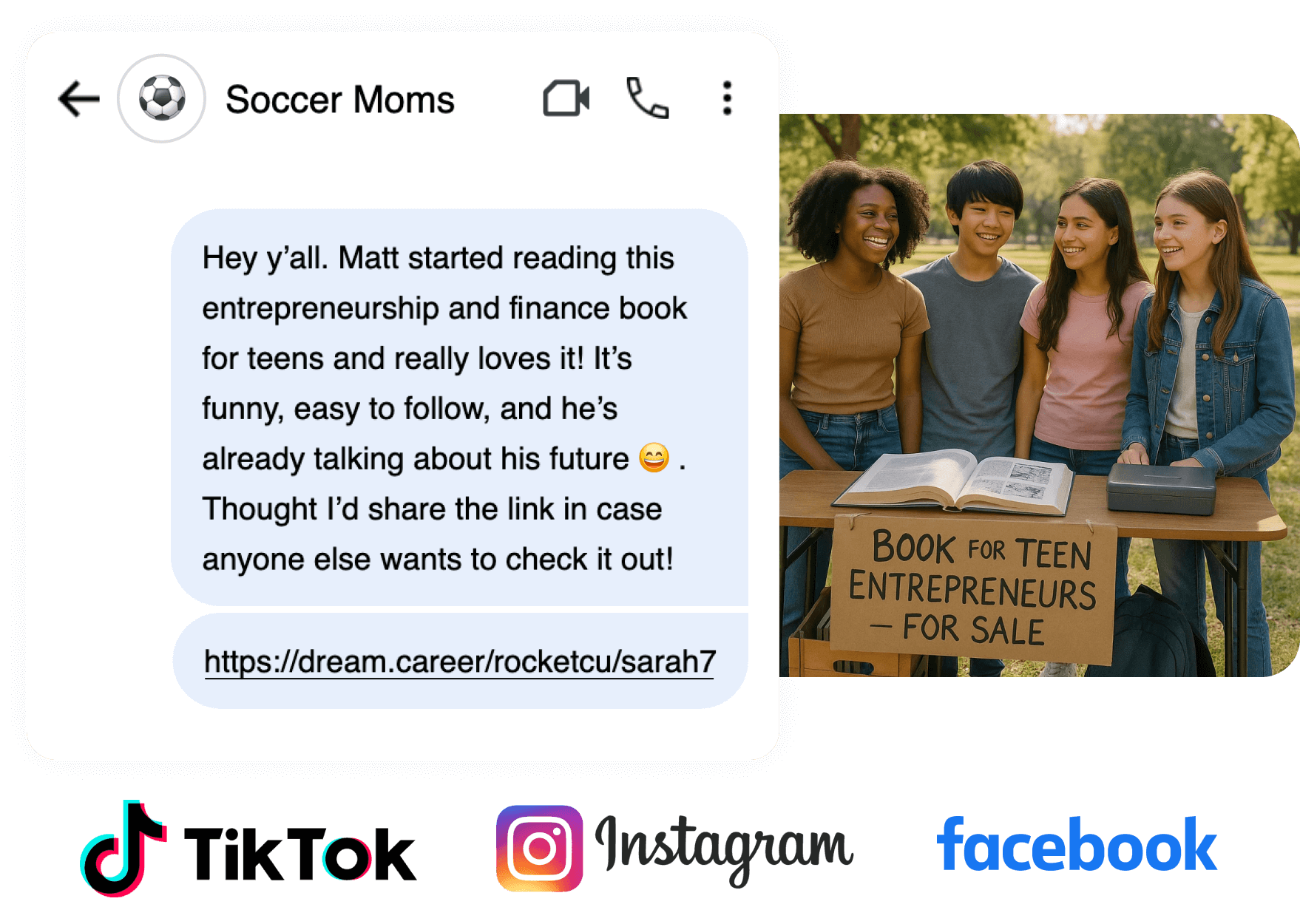

Community-powered growth engine.

Each book sparks online and offline word-of-mouth. We reach local households through TikToks made by teens and parents, sharing their journey with the book.

- Shareable codes built into every book

- Track growth in real time

- See which families are driving local buzz

Spark local family loyalty.

By helping teens take their first step into entrepreneurship, you’re not just educating—you’re fueling economic opportunity in your community.

- Creates local economic opportunity

- Positions your CU as a launchpad

- Sparks generational impact

Those who reach the next generation win.

The rest may be forgotten.

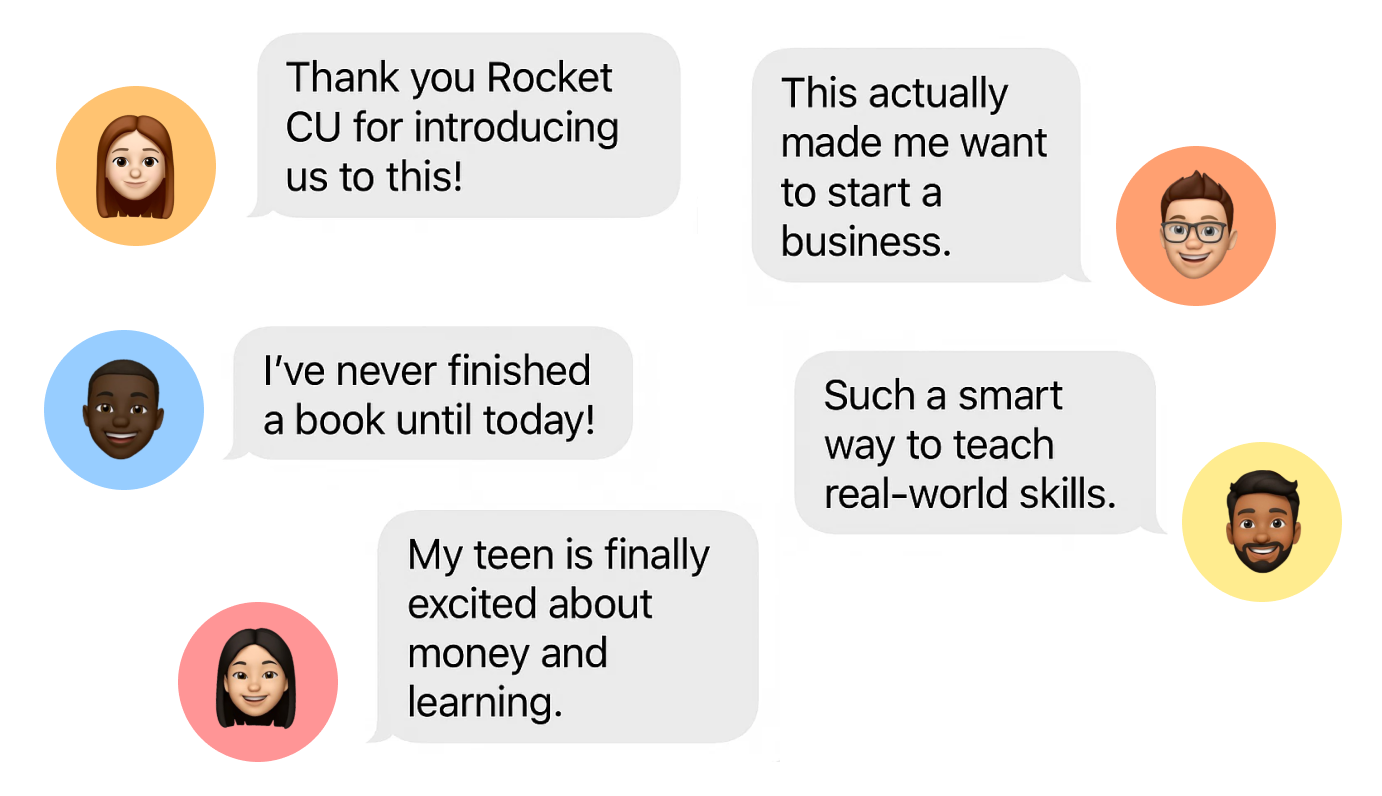

What people are saying

A co-branded graphic book series that is:

Engaging

59% of Gen Z would choose the graphic version of a story rather than a text-only book — that number jumps to ~70% in historically underserved communities.[3]

Bite-sized & short chapters

Hand-drawn comic strips

Learning through storytelling

Educational

Helping teenagers build the timeless skills, habits, and mindsets for entrepreneurship and financial wisdom. Following the Jump$tart Coalition's National Standards for Personal Finance Education.

Easy to follow with challenges

Timeless lessons that never expire

Worksheets to help educators

Converts

We go beyond awareness — our books drive real action. With built-in referral systems, localized marketing, and email touchpoints, we help credit unions grow their youth and parent member base together.

Built-in referral engine

Engages both parents and teens

Trackable conversions & insights

Lasts

Books are timeless assets — they live in schools, homes, libraries, and minds. They shape identity. They’re passed down. They last.

Living asset in your community

Inspire on a deeper level

Passed down to generations

Built by a team with experience.

Dream was founded by Simon Komlos, co-founder of Zogo (acquired), which partnered with 200+ credit unions and helped over 2 million people learn financial skills. He was named Forbes 30 Under 30 in Education.

At 12, Simon was struggling in school until a pen-pal introduced him to coding. That spark turned him into a self-taught programmer and changed his life. Now, he’s building Dream to pass that spark of curiosity and opportunity on to the next generation.

, COO

, COO